Hybrid work is key to return-to-office-planning but internet connectivity at home poses challenges

Most buildings and tenants are highly prepared to welcome employees back to the office, having developed plans and outfitted their buildings to ensure safety, comfort and well-being while accommodating the growing demand for remote work opportunities that provide the flexibility to recruit and retain talent. At the same time, large numbers of employees lack access to stable high-speed internet service at home, creating a paradox as companies navigate the new normal in a post-COVID world, according to a first-of-its-kind occupancy survey released today by commercial real estate and facilities management advisor Blue Skyre IBE.

Blue Skyre, together with advisement from Peter S. Kimmel & Associates, recently partnered with the Counselors of Real Estate, International Facility Management Association, Institute of Real Estate Management and International WELL Building Institute to survey frontline building management professionals about their return-to-office-occupancy plans. The online survey was conducted by HarrisX. Corporate sponsors included workspace innovation firms Davies Office Inc., Planon and Unispace.

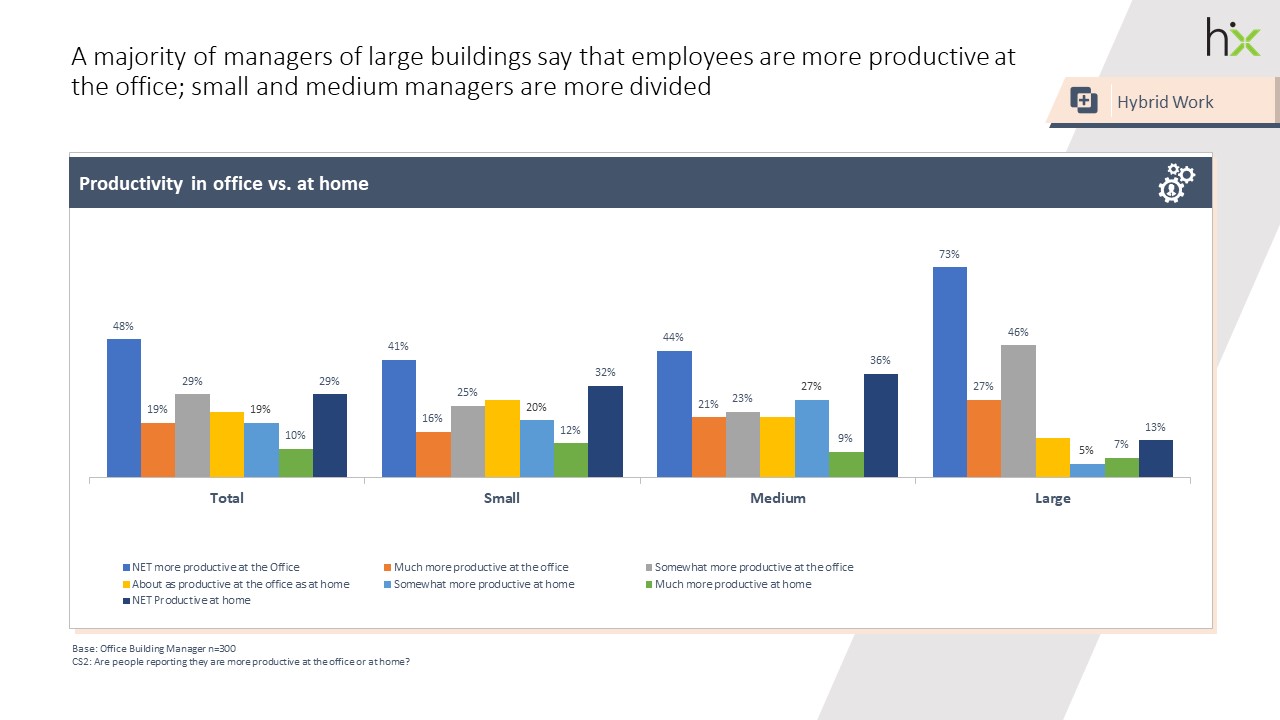

“The COVID pandemic will have a lasting impact of redefining how and where people work. It also placed a new lens on the health, safety, wellness and productivity of employees,” said Maureen Ehrenberg, FRICS, CRE, Chief Executive Officer of Blue Skyre. “The workplace seems to be well-prepared for a re-occupancy, which is healthier and occupant-friendly with more wellness and concierge services. With the challenges of reliable high-speed internet serving employees at home, it’s arguable as well that the workplace at times may be more productive, especially when meeting and collaborating through video conferencing is a critical component of remaining visible and engaged with clients and team members.”

Kimmel added, “The hybrid workplace clearly has arrived and will not go away. The next step is to conduct additional research on how to make the hybrid work arrangement most successful. I expect that to do this, there will be studies on the types of work and workers best suited for office and remote work locations, and what can be done to enhance productivity for each.”

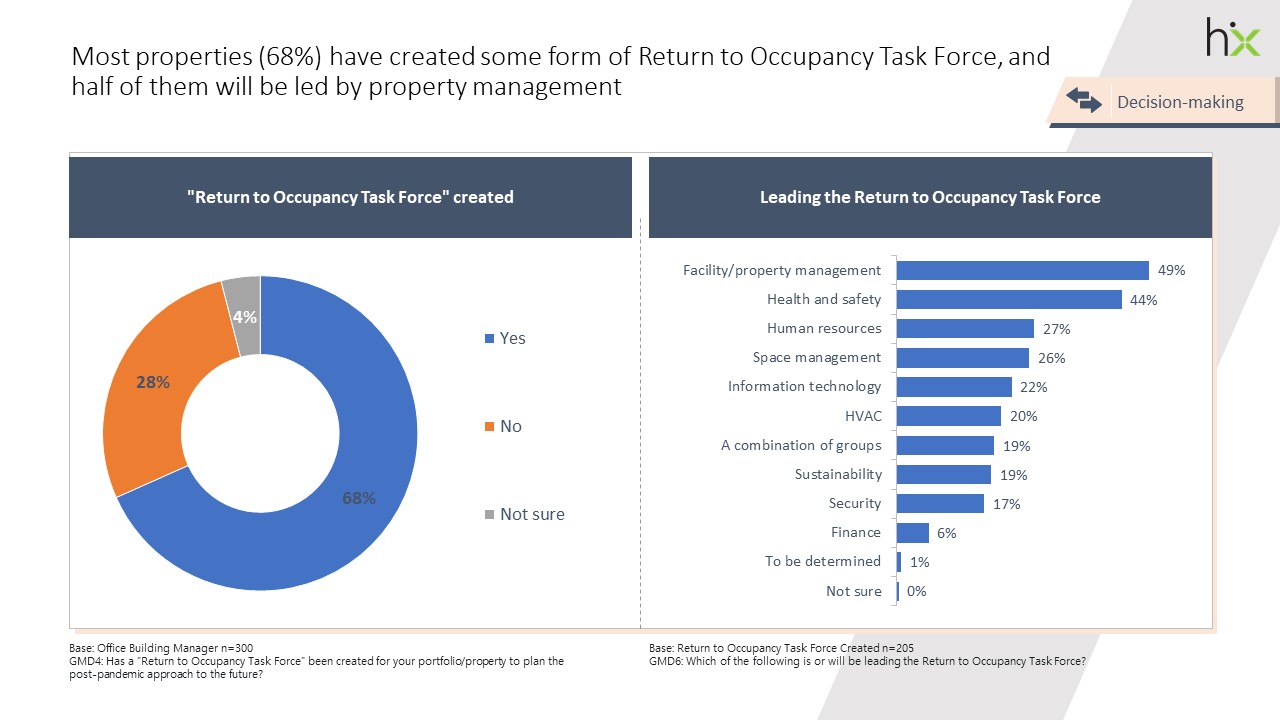

According to the survey, 68% of companies have created a return-to-occupancy task force and nearly all crosscut many corporate functions, including property and space management, human resources and IT. Additionally, a large majority of building managers have or are preparing a documented return-to-office plan (84%) and are confident in the plan (90%). They also are preparing for potential COVID surges; 60% already have a documented contingency plan and 30% are preparing one.

“This insightful survey clearly demonstrates the justified importance placed on health, well-being, safety and the workforce experience now and post-pandemic, as well as the need for technology and data to thoroughly understand behavior and develop the metrics needed to effectively manage our facilities for our workforces,” said Peter Ankerstjerne, Chief Strategy Officer of Planon, a global leader in digital workplace and smart building solutions, and Chairman of the Global Board of Directors at IFMA.

Remote work is the new competitive advantage, but companies face productivity challenges

When asked how companies are planning to retain talent, 58% of those surveyed say they will allow employees to choose how many days to work remotely. Other top strategies companies are choosing to retain talent include providing amenities for well-being through incentives (49%), allowing employees to work remotely from anywhere (48%), and paying for relocation expenses for key talent (46%).

Companies also plan to support work from home by providing or reimbursing employees for software (70%), office equipment such as printers, computers and mobile or landline phones (69%), and well-being reimbursements (46%). Nearly half (45%) said they will offer new work from home financial subsidies for existing home expenses, such as rent or mortgage reimbursement and insurance.

However, 40% of respondents estimate at least half of the employees at their facilities lack high-speed internet connectivity at home that would better facilitate remote work.

Re-occupancy plans put safety first

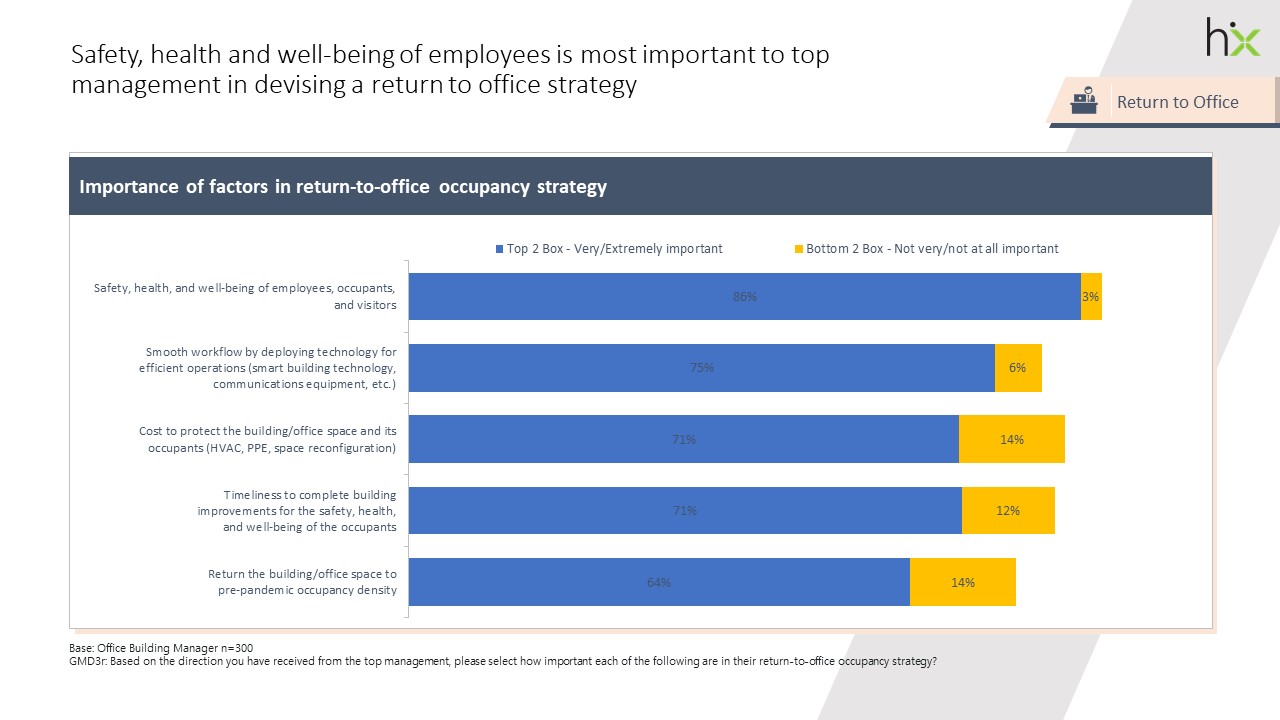

Although many factors played a role in return-to-occupancy planning, the safety, health and well-being of employees, occupants and visitors ranked highest with 86% of the managers responding it was leadership’s top concern. Returning the building/office space to pre-pandemic occupancy ranked lowest in terms of importance to top management at 64%.

Nearly half of the companies are planning to increase the budget by more than 10% for security systems, technology and wellness amenities. In addition, 61% said they have or are planning to add health and wellness services.

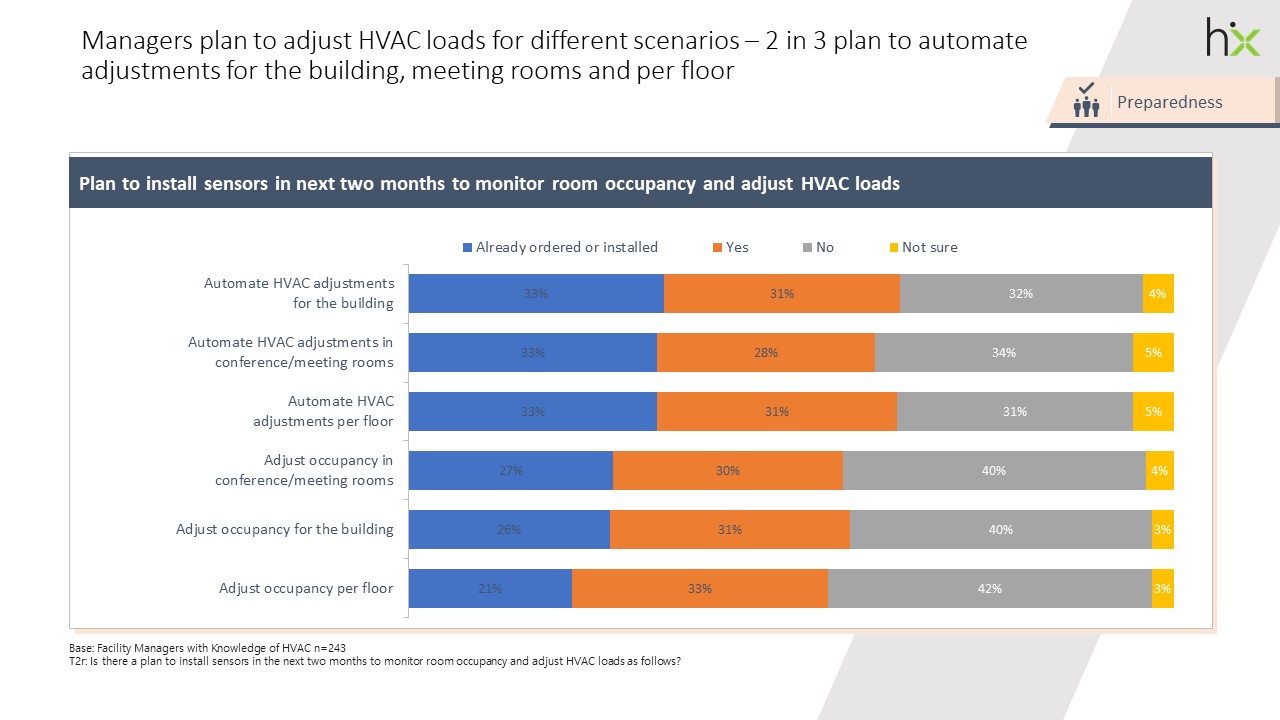

Nearly all respondents (94%) said their buildings either have been or are being equipped with improved HVAC air filtration systems. This was followed by additional security measures, including automated biometric and temperature scanners and desk and meeting room reservations. Two-thirds of buildings will have hand sanitation stations and frequent cleaning of high-touch areas, and 62% of those surveyed say temperature checks will be required to enter the office.

“With the majority of survey respondents ranking safety, health and well-being of the people in the building as the top concern in return to the office, there is a clear opportunity for leading building professionals to also serve as health professionals. Building health impacts human health. It is important we provide the information and tools to position them to do so at their best,” said Whitney Austin Gray, senior vice president and lead of research at the International WELL Building Institute.

Goodbye private offices, hello smaller networked meeting spaces

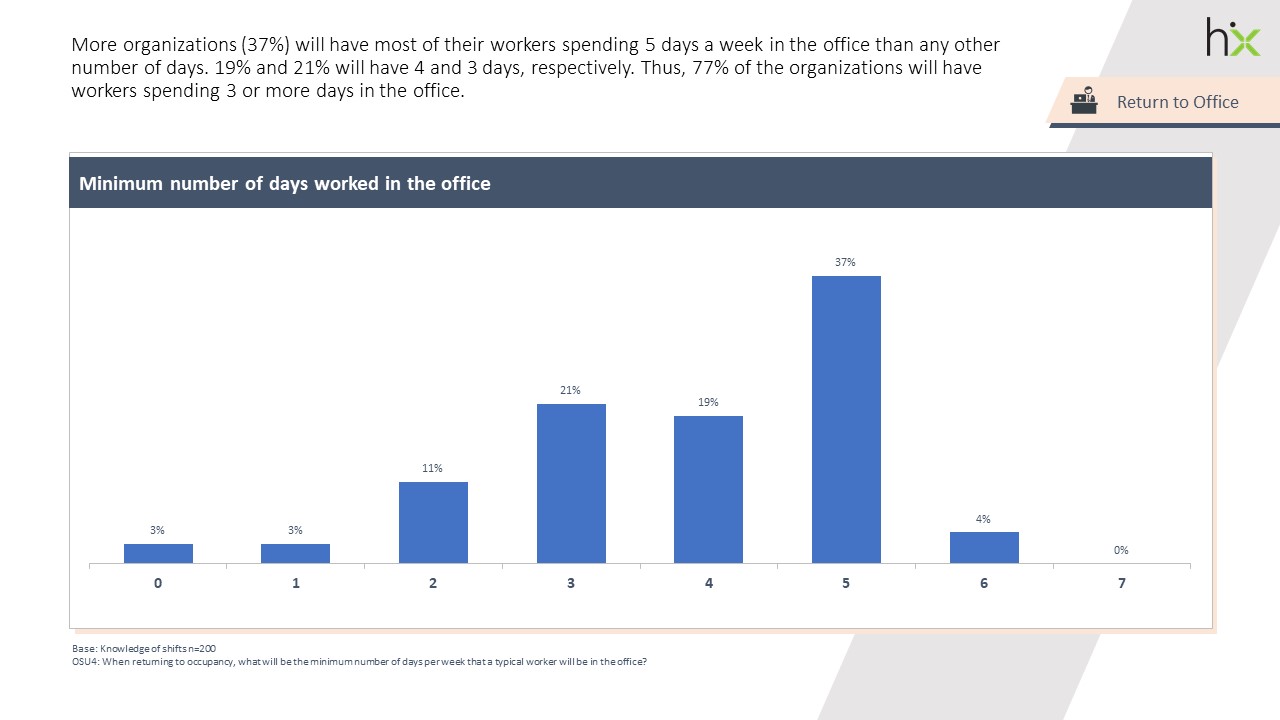

A majority of those surveyed (55%) say their return-to-office plan is to have over half of their staff spend at least three days in the office with 23% saying workers will spend 50% of their time in the office and 21% expecting most staff to work remotely most of the time.

Nearly an equal amount of survey respondents foresee a reduction in the number of conference rooms for more than 10 people (54%) and private offices (53%) in the next two years. Three-quarters of respondents plan to increase the number of conference/meeting rooms with networked audio and visual capabilities, while nearly two-thirds foresee both more conference rooms for 10 or fewer people and an increase in outdoor meeting areas.

Despite the changes to the workspace, more than half (54%) say their organization is not planning to change their real estate footprint by either adding or giving back square footage.

“The workplace will no longer facilitate focus and learning activities – those things can happen remotely. What successful future offices will do is enable the activities for people to connect – group problem-solving, collaborative innovation and social activity. Likewise, the space types in every office will need to change to support that shift in employee experience,” said Michael Casolo, Chief Revenue Officer of Unispace.

The Return to Occupancy Survey is available to download upon completion of a brief form, from the Blue Skyre website.

Methodology: Blue Skyre IBE LLC commissioned HarrisX to conduct a survey of commercial real estate professionals. The total sample size was 458 facility and building managers and real estate consultants across the U.S. and Canada. The survey was conducted online from June 28-Aug. 12, 2021. The sampling margin of error of this poll is plus or minus 4.58 percentage points.