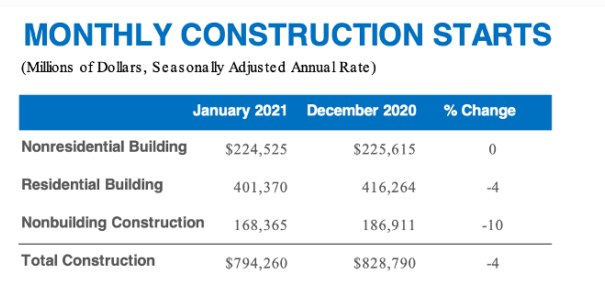

Total construction starts dropped 4% in January to a seasonally adjusted annual rate of $794.3 billion. Nonresidential building starts were flat in January, while nonbuilding starts dropped 10% and residential starts were 4% lower. From a regional perspective, starts were lower in three of the five regions – the Midwest, South Atlantic, and South Central. Starts rose, however, in the Northeast and West.

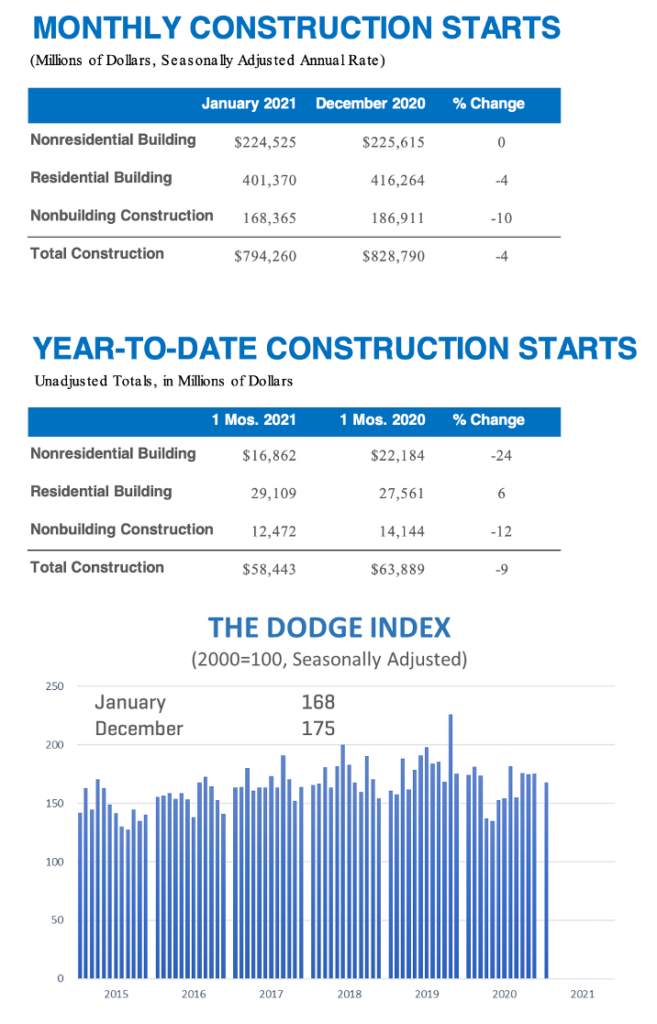

With only one month of 2021 completed, a year-to-date analysis will provide little useful information. Additionally, January 2020 (i.e. pre-pandemic) was the culmination of a strong cyclical upswing in construction starts that began in 2010 and thus provides a poor point of comparison. An alternative viewpoint for analysis is comparing 12-month totals. For the 12 months ending January 2021 total construction starts were 11% below the 12 months ending January 2020. Nonresidential starts were down 25%, while nonbuilding starts dropped 15%. Residential starts, however, were 5% higher for the 12 months ending January 2021. In January, the Dodge Index lost 4% to 168 (2000=100) from the 175 reading in December.

“The tenuous beginning to construction starts in 2021 highlights the long and rocky road ahead for the sector this year”, stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Over the course of the year the economy will recover as more Americans receive their vaccinations. However, the construction sector’s recovery will take time to materialize due to the deep scars caused to the industry by the pandemic. Patience will be key in the months to come.”

Nonbuilding construction started 2021 with a resounding 10% decline in January to a seasonally adjusted annual rate of $168.4 billion. Every nonbuilding sector posted a decline during the month — environmental public works fell 6%, highways and bridges dropped 7%, while starts in the utility/gas plant category lost 13%, and miscellaneous nonbuilding starts plunged 17%.

The largest nonbuilding projects to break ground in January were the $825 million (450 MW) Desert Quartzite Solar Facility in Blythe, California, the $427 million (345 MW) Mesquite Sky Wind Farm in Putnam, Texas, and the $375 million (300 MW) RE Slate Solar Farm in Stratford, California.

For the 12 months ending January 2021, total nonbuilding starts were 15% lower than the 12 months ending January 2020. On a 12-month sum basis, street and bridge starts were 5% higher, but environmental public works starts were 3% lower, miscellaneous nonbuilding starts dropped 28%, and utility/gas plant starts lost 40%.

Nonresidential building starts were unchanged in January at a seasonally adjusted annual rate of $224.5 billion. Commercial starts were 1% higher during the month as a sizeable gain in warehouse construction offset declines elsewhere. Institutional building starts fell 9% in January, with education and healthcare construction down sharply. Manufacturing starts, meanwhile, rose 81% due to the start of two large projects.

The largest nonresidential building project to break ground in January was Nucor’s $850 million steel mill in Brandenburg, Kentucky. Also starting during the month were Nikola Motor’s $470 million hydrogen-electric truck plant in Eloy, Arizona, and the $327 million Riddle Hospital campus modernization in Media, Pennsylvania.

For the 12 months ending January 2021, nonresidential building starts tumbled 25% relative to the 12 months ending January 2020. Commercial starts dropped 27%, institutional starts were 15% lower, while manufacturing starts collapsed 59%

Residential building starts fell 4% in January to a seasonally adjusted annual rate of $401.4 billion. Multifamily housing starts were 7% lower, while single-family dropped 3%.

The largest multifamily structure to break ground in January was the $200 million DOT Block Residences in Dorchester, Massachusettes. Also getting underway during the month were the $153 million Halley Rise Block D-1 mixed-use building in Reston, Virginia, and the $112 million 1400 W Randolph St apartments in Chicago.

For the 12 months ending January 2021, total residential starts were 5% higher than the 12 months ending January 2020. Single-family starts gained 12%, while multifamily starts slid 12% on a 12-month sum basis.