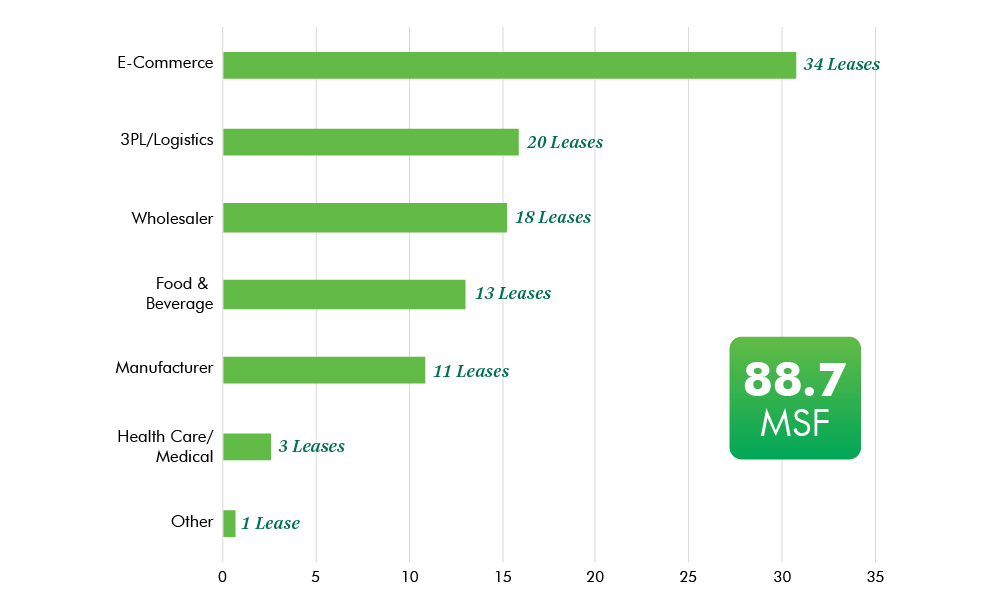

The food and beverage industry, driven by the expansion of grocery delivery, significantly expanded its share of the largest 100 U.S. industrial and logistics leases by square footage last year while the share claimed by e-commerce and logistics companies receded, according to a report from CBRE.

The food and beverage industry accounted for several million additional square feet of the largest industrial leases last year than in 2018 as grocers and distributors continue to build out their supply chains for home delivery. Specifically, food and beverage companies claimed for 13 of the top industrial leases for a cumulative 13 million sq. ft., up from nine leases for 8.8 million sq. ft. in 2018.

E-commerce companies and logistics companies – which include third-party logistics providers who handle distribution for other companies – accounted for 52 percent of the square footage in the largest 100 industrial leases last year, down from 61 percent in 2018, CBRE found. Still, e-commerce and logistics remain juggernauts for warehouse leasing, accounting together for far more leases (54) and square footage (45 million) last year within the top 100 than the next-closest category – wholesalers at 18 leases for 15.2 million sq. ft.

“This report, which our team completes each year, often provides us a rough outline of important trends within the industrial and distribution sector — and the growth of grocery delivery is a clear factor this year,” said John Morris, Executive Managing Director leading CBRE’s Americas Industrial & Logistics business. “E-commerce and logistics companies are the needle movers, but food and beverage quickly has established itself as a major player in industrial real estate leasing. This projects continued growth for both dry and cold-storage warehousing this year.”

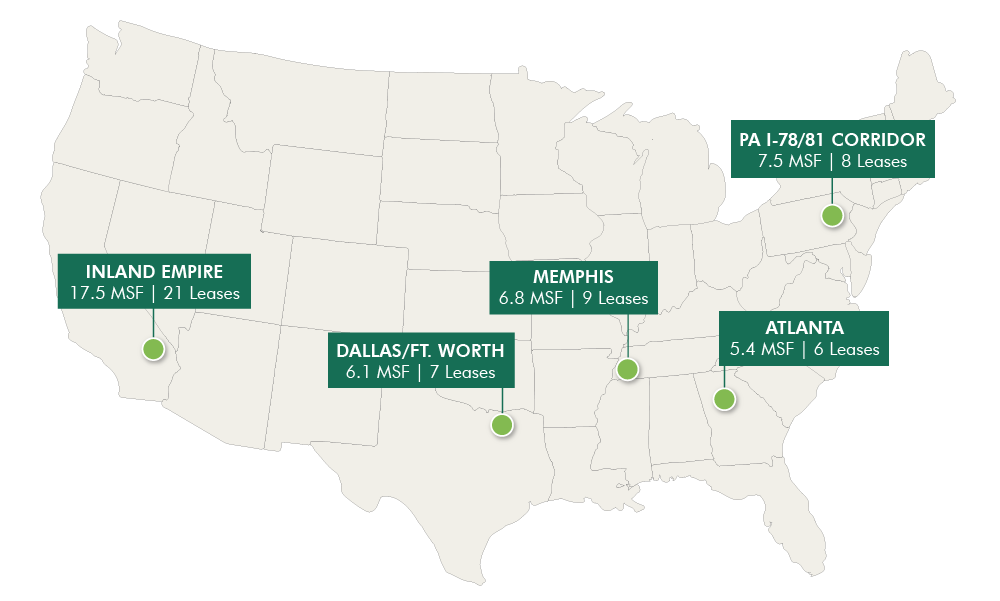

Geographically, California’s Inland Empire remains the capital of big industrial leases, more than doubling the activity of the next busiest market in terms of the largest leases. Memphis leapt into the top five for 2019 with nine massive leases.

“Large warehouse leases tend to cluster in major distribution markets, most of which are near busy ports, large population centers and robust transportation networks,” said James Breeze, CBRE Global Head of Industrial & Logistics Research. “These rankings don’t fluctuate much from year to year for that reason. However, we do see smaller hubs like Memphis, Indianapolis and Columbus gaining momentum.”

To download the report, click here.