Healthcare sector persists despite mounting pressures and disruptions, finds JLL

The last few years tested the healthcare industry in unanticipated ways, adding stress on systems to contain costs in a tight labor market all while preparing for economic uncertainty. Despite the challenges, the medical office sector remains one of the most resilient commercial real estate sectors, and investors view it as a key alternative asset class due to unwavering demand.

Global real estate and professional services firm JLL’s new Healthcare and Medical Office Perspective details key themes currently affecting U.S. healthcare systems and medical office owners and operators, including labor challenges, elevated costs and industry disruptions. These factors, among others, put pressure on health system margins and provider performance, yet the industry continues to adapt and grow.

Health systems and other care providers continue to face economic challenges in the aftermath of the pandemic, including labor shortages, payor and reimbursement pressures and disruption from innovation and new entrants into the sector. Facilities offer both risks and opportunities to healthcare providers, and, despite the challenges, the critical nature of healthcare and large tailwinds from a growing and aging population continue to make healthcare real estate one of the most stable asset classes for investors.

Johnson, national practice leader, Healthcare Markets, JLL

Healthcare industry under pressure

Healthcare system margins are impacted by higher cost pressures than ever before, and, although margins are projected to improve, 75% of hospital CFOs still plan to decrease their operating budgets, according to a survey from The Academy.

Like many industries coming out of the pandemic, healthcare systems and providers face persistent talent shortages that are slimming margins. The U.S. Bureau of Labor Statistics (BLS) predicts a shortage of over 203,200 registered nurses each year through 2030. The vicious cycle of chronic under-staffing puts significant cost pressure on healthcare systems, which are paying higher wages to attract and retain nurses. Labor accounts for 55% of healthcare systems’ operating costs, and Kaufman Hall reports that median labor expenses increased 37% from 2019 to March 2021.

The payor mix is shifting toward publicly funded sources fueled by aging and income-driven demographic tailwinds. Government-sponsored healthcare coverage is expected to grow by 19% through 2028. With a higher percentage of payors relying on Medicare and Medicaid’s pre-determined and fixed repayment rates, hospital systems could seek to recoup additional revenue from private payors. Additionally, employer-sponsored benefit costs are expected to rise an average of 7.6% in 2022.

Real estate can account for up to 40% of the balance sheet for most healthcare systems and hospitals, so leveraging real estate for cost savings can help improve margins. As margin relief becomes vital, both established and scaling systems turn to creative real estate solutions like portfolio overhauls and optimizations, lease restructures, strategic location analytics and divestments of non-core assets to help their bottom line.

Disruption is mounting

The healthcare industry has experienced disruptions such as on-demand access to care, technology and more choices for patients. Factors like location convenience, protocol expectations and consumer preferences for differentiated care all affect whether a patient remains loyal to their provider.

Additionally, capital investment and big tech are driving new disruptions. Venture capital in digital healthcare reached $15.4 billion in 2021, an all-time high, and 46% of that was dedicated to the healthcare services sector. Global technology companies are also entering the space through pharmaceutical, personal health tracking, virtual clinical trials and health insurance, and private equity sees healthcare as a safe bet, with 40% of private equity firms most interested in healthcare IT.

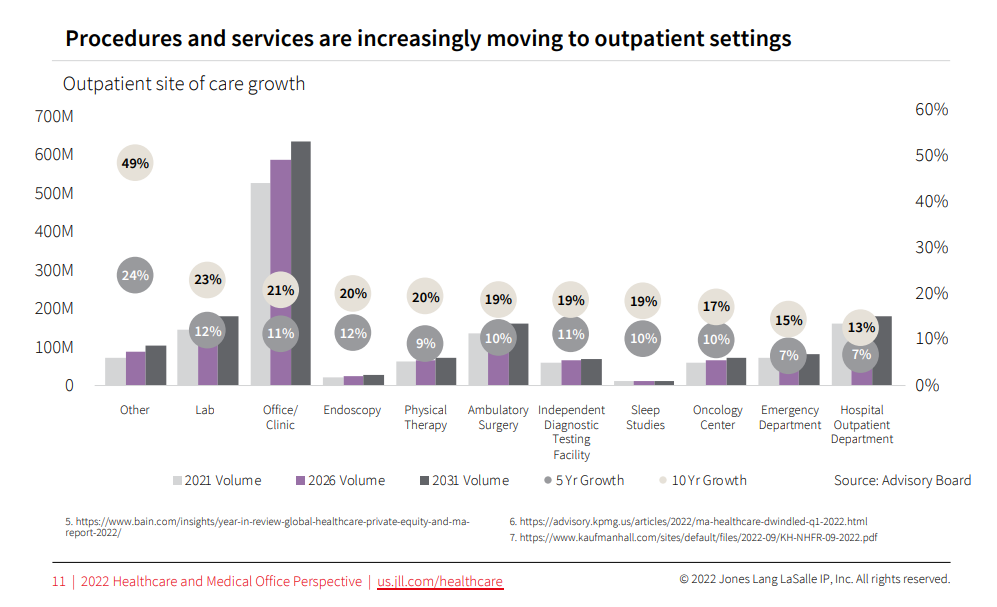

Growth in outpatient demand is also driving activity — and competition — among healthcare systems. A continued shift toward outpatient services will drive provider demand, as well as consumer preference for more convenient and accessible outpatient facilities.

The challenge most health systems and outpatient accessible facilities operators must consider is their overarching strategy to attract and retain targeted population demographics. Leveraging their physical assets in a more efficient way that enhances the patient experience will become more critical in a post-pandemic healthcare marketplace.

Vionnta Rivers, Executive Director, Solutions Development, JLL

Systemness continues as a key strategy to consolidate and manage costs

Systemness seeks to provide better care to more people at lower costs by operating in optimal and efficient ways to align, coordinate and leverage all service lines, locations and stakeholders. After a record-breaking year for M&A revenues in 2021, consolidation within the healthcare industry has continued well into 2022. Industry leaders expect M&A activity to continue, as smaller hospitals that are struggling financially join larger systems or merge to create scale, reduce costs and improve the quality of their care through systemness.

Systems are also following patient populations to retirement markets, and the Sunbelt markets are the biggest beneficiaries, with 19% population growth over the past decade. By 2030, projections show 55% of the national population will reside within the Sunbelt.

Typically, high-growth markets have lower costs, but, because of migration surges, we can expect more accelerated cost growth. In fact, inflation has been accelerating faster in these markets relative to the U.S. due to this very trend, so, while costs may be lower, high-growth markets may also experience more rapid price changes.

Maddie Holmes, senior research analyst, Industry Insight & Advisory, JLL

Medical office is a defensive investment class

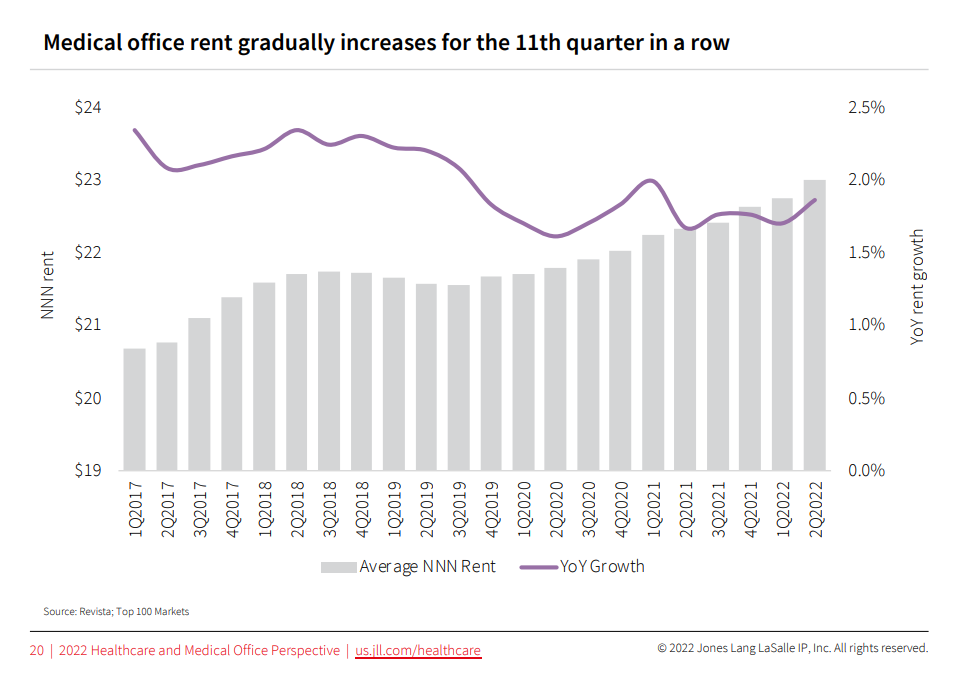

Absorption has outpaced new supply and occupancy has remained consistently high above 90% for twenty years, aided now by construction delays during the outset of the pandemic and resulting fall in completions amid steady demand for medical office. Medical office occupancy is relatively stronger than the commercial office sector and was significantly less disrupted by pandemic, with medical office asking rents averaging 2% growth year over year for the past five years and reaching an average $23 per square foot triple net by mid-year 2022.

Medical office sales reached $9.2 billion in the first half of 2022 after a record performance and investor interest in 2021. JLL anticipates 2022 to close at another record year. Strong demand for healthcare services and the continued shift to outpatient care assure healthy investor appetite for medical office.

Medical office buildings are an attractive alternative asset class to investors during uncertain times due to their stable occupancy and durable income, offering consistent rental rates with annual growth. Medical office is a defensive investment property class in today’s market due to the steady demand for healthcare services.

Mindy Berman, senior managing director, JLL Capital Markets

Healthcare and Medical Office Perspective is available to download from JLL.